Easier finance management with Isolta Debt Collection service

All the users with Isolta Premium -plan are now able to outsource individual invoices payment reminding and debt collection to a trustworthy debt collection agency.

Isolta Debt Collection service is provided by cooperation with Uuva Oy. Company has been working in the field for over 26 years. High quality and professional service reduces your workload and allows you to focus on productive work.

Why should you outsource invoices payment reminding and debt collection?

- Client’s motivation to pay is higher with help of the debt collection agency

- You will save time when you outsource the payment control

- You will save money from sending payment reminders

- Possibility to get money in your account quicker and more securely

Wow, sounds great! How does it work and how much does it cost?

Short answer: with small amount of effort and it’s inexpensive

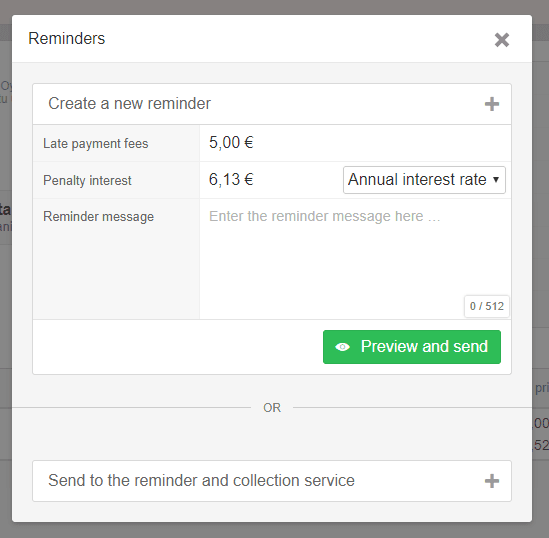

A slightly longer answer: You can send your overdue invoice information to Isolta Debt Collection service by just clicking few buttons: Open overdue invoice, click “Reminders” and then choose “Send to reminder and debt collection service”.

After that sending the reminder and other future actions regarding that overdue invoice will be done for you. You do not have to think about receivables from overdue invoices, money will be transferred in your account after a successful payment reminding and debt collection.

So you can choose which invoice you wish to send to the Debt Collection service and which invoice you will handle yourself.

Our partners will send invoice payment reminders, handle the debt collection and transfer money in your account after invoice receiver pays the invoice.

The biggest thange in your process is in the invoice reminder bank account number. The bank account is changed to our partner’s bank account in the reminders that are sent to the service.

Service price

Sending the invoice payment reminder is free of charge. It will be charged only after the invoice is paid. For each payment a one-time payment of 0,35 € is charged.

Okay, sounds good! How can I start using the service?

Debt Collection service is available to all Isolta’s Premium -plan users.

Current Premium users can send an overdue invoice to the Isolta’s Debt Collection service: open the overdue invoice, create payment reminder and choose it to be sent to the Isolta’s Debt Collection service.

The first time you use it, you will get to read the terms and conditions from our partner. After reading and thus accepting them, you can send the invoice to the Isolta’s Debt Collection service.

During the first time an user account will be created for you in our partner’s system, through which you can view the status of the payment reminder. This user account will be created automatically based on the sent payment reminder information, so you don’t need to take any action.

If you are not yet a Premium version user, you can order it by logging in to Isolta and making an order from the software.

Frequently asked questions

To what bank account the payments will be transferred?

The payment will be transferred to the account which was on the first invoice you sent to the Isolta Debt Collection service. If you wish to change the bank account, please contact us!

Wait a minute, so my client won’t make the payment directly to me or my bank account?

Nope. When you send the overdue invoice to Isolta Debt Collection service, the payment goes through our partner. They will make the settlement for you.

From where can I view the status of the payment reminder and debt collection?

During the first time of the use, an user account will be created for you in our partner’s service. Through that account you will be able to view the status of the payment reminder and debt collection.

What is a payment reminder?

Payment reminder is a written and / or electronic notification by the invoicer / creditor or his authorized representative that the invoice is still open and that the invoice has not been paid by the due date. Payment reminder shows how an open invoice relates to that reminder. A good payment reminder also includes instructions for action if the claim can not be paid in full amount, but is paid for in e.g. part-payments.

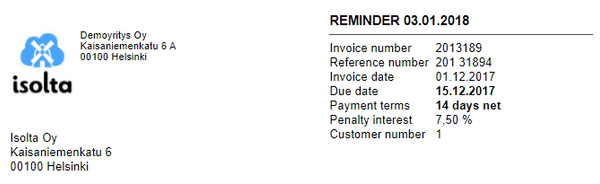

What information is in the payment reminder?

You do not have to worry about the right information, we will review them for you and our partner will take care of the legal requirements for payment reminder. You can focus on the essentials, that is, to do productive work. Payment reminder includes at least the following information:

- the creditor’s name and address

- the claim of the receivables, the invoice identification data and the total invoice amount

- payment account and due date

- the name and address of the customer

- information about whom to make any complaints on the receivables of the collection costs etc., and in what time

When the payment reminder can be sent?

Company debt collection

The payment reminder can be sent to a company immediately after the invoice is overdue. This is not specifically defined by law. According to a good debt collection practice, a payment reminder can be sent to a company 5 to 7 days after the due date.

Consumer debt collection

Payment reminder can be sent to a consumer after the invoice is overdue, although the reminder fee of 5 € as defined in the Consumers’ Law may only be required if the debt is overdue for at least 14 days.

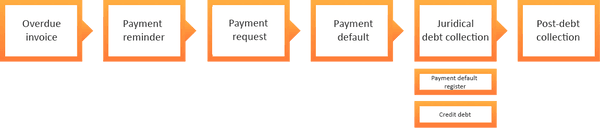

When is the payment reminder sent, when I send an overdue invoice to the Isolta Debt Collection service? And how about debt collection letter?

Payment reminders are processed to the mailing service in the same evening as it is sent to our service. So the reminder is sent within 1-2 days after you send it to our service.

Debt collection letters are sent with a certain pattern: the date of the reminder sent + payment terms + control perioid. This means that for example in the consumer reminder there is 10 days payment terms + 4 days for control perioid (note the weekends and public holidays). If there is no payment made within that time, the debt collection letter is sent.

What are the late payment fees and penalty interest for the reminders?

In a consumer payment reminding, a creditor can legally claim reasonable debt collection fee. According to the Consumer Act, a reminder fee of 5 € (if an invoice is 14 days overdue) and a default interest in accordance with the Interest Act may be claimed for consumer payment reminder. Currently, according to the Interest Act, the interest rate is 0.0% at the period 07.01.2017 – 31.12.2017. The default interest for the same period is therefore 7,0% per annum under the statutory interest rate (reference rate 0% + interest rate 7% additional interest).

A reminder fee for the companies starts at 8,40 € and goes up to 25,00 €. The amount depends of the capital and other possible special arrangements.

If not specifically agreed upon trade between companies, the creditor has the right based on commercial contracts to demand legal interest from the debtor from the due date. A legitimate interest in trade between the businesses of the reference rate of the European Central Bank (ECB), plus 8 percentage units. At present, the statutory default interest rate for commercial agreements in commercial transactions is 8% (reference rate 0% + interest rate on the 8% interest rate).

What are the expenses / fees in the debt collection letters for my customers?

In a consumer debt collection, the fees are regulated by the law. You can find the table of the fees here.

In a companies debt collection, the fees vary case by case. The affecting factors are the amount of work done for the collection, amount of the capital. So there is no fixed price list for those fees. If you want to know an estimate of the fees, please contact our partner customer service.

How can I cancel the reminder or debt collection service and what it costs for me?

You can cancel the assignment by contacting our partner customer service.

Note that if you cancel the assignment after there has been activites regarding the debt collection or the assignment unfounded, our partner may charge the debt collection fees from you.

What if my client pays the invoice to me with the original sum (without late payment fees etc) even I have sent the overdue invoice to the Isolta Debt Collection service?

First of all you should contact our partner customer service and let them know about the payment. Next steps in the process are decided case by case.

Scenario 1 – Your client pays the invoice late to you and you cancel the debt collection assignment

You inform our partner about the payment as well as the date of the payment. If there are activities carried out regarding the debt collection, our partner may continue the debt collection for the fees and you will be invoiced only the compulsory VAT which you can reduce in your taxes.

Scenario 2 – Your client pays the invoice directly to you in order to avoid debt collection fees. After that you cancel the assignment

If you cancel the assignment and there is an assumption of the exploitation of the service for free, our partner may charge the fees from you.

Will there be juridical debt collection automatically?

No, our partner will contact you before the start of the juridical debt collection.

What is the difference between Isolta Debt Collection service and Isolta Payment Control service?

With Isolta Debt Collection service you can choose which invoices to send to the Debt Collection and which you will handle yourself.

With Isolta Payment Control all of your sent invoices payment reminders and debt collection will be handled by our partners.

Any further questions?

We are happy to give additional information about Debt Collection service, as well as other financial management related information. Contact us via Chat at the bottom right corner or send us a message via our contact form.